COVID-19, serious impact on Japanese economy

Construction prices are expected to decline due to a significant decrease in private construction investment

Business Conditions in the Construction Industry (Future) Significantly worsen

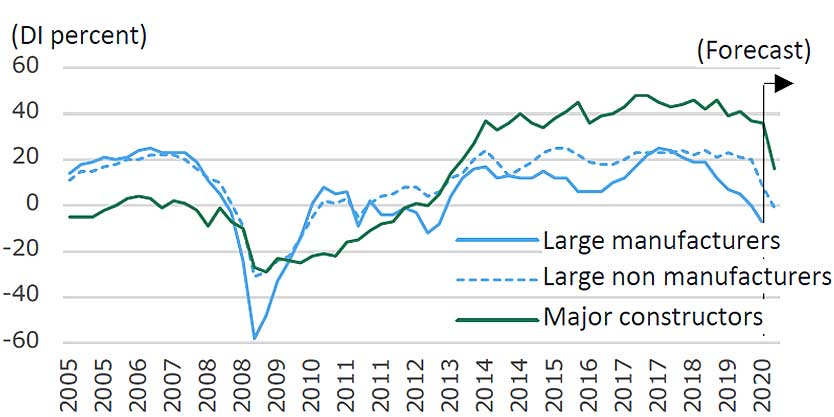

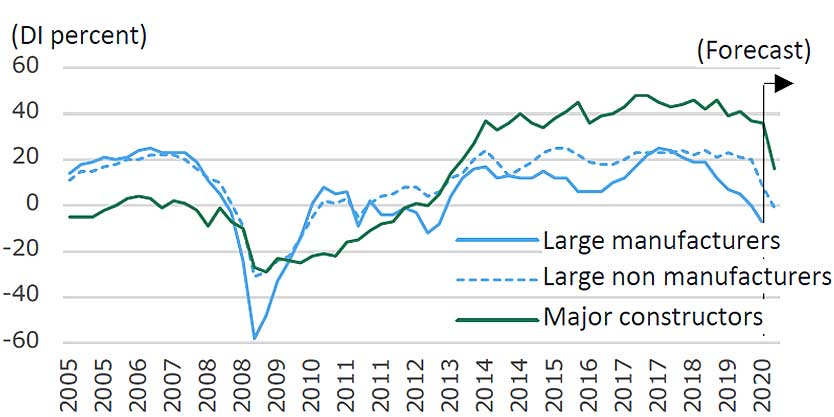

It is predicted that the decline in corporate performance related to COVID-19 will spread widely not only to the manufacturing industry but also to the non-manufacturing construction industry (Japan Economic Research Center). The BOJ Tankan (March survey) business condition index DI is -8 points (0 → -8) for large manufacturing companies. Large enterprises non-manufacturing industry decreased by 12 points (20 → 8), which markedly deteriorated both manufacturing industry and non-manufacturing industry outlooks. The construction industry, which had been comparatively strong up to now, decreased by 1 point (37 → 36), but the outlook for business conditions, which shows the outlook three months ahead, fell significantly by 20 points (36 → 16). (Figure 1). With the deterioration of domestic business performance, the extent of deterioration may increase further.

Real GDP growth rate drops drastically equivalent to Lehman shock

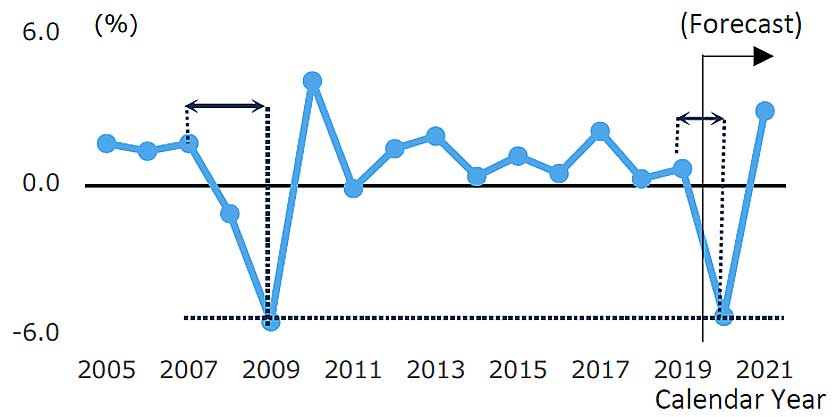

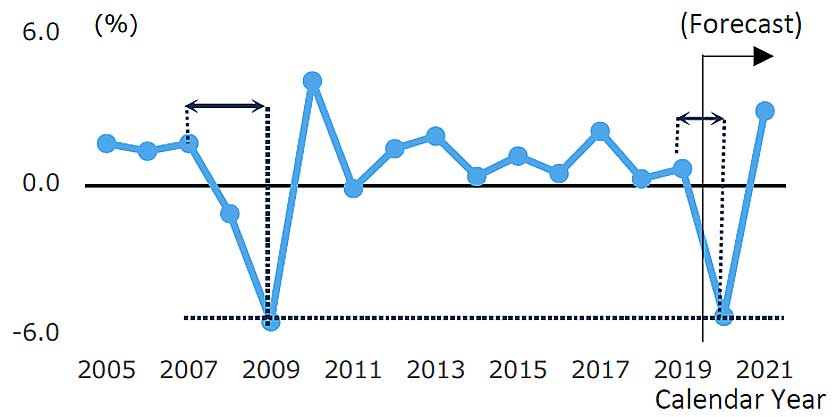

The impact of the COVID-19 global epidemic on the domestic economy is thought to be felt in the medium to long term due to the deep negative effects of both supply and demand. According to the International Monetary Fund (IMF) forecast, Japan's real GDP growth rate in 2020 is -5.2%, which is the same level as at the time of the Lehman shock in 2009 (base scenario where the pandemic will peak in the latter half of 2020). (Figure 2).

-

Fig.1 Historical change in Business Condition Judgement

Fig.1 Historical change in Business Condition Judgement

Source: BOJ “TANKAN”

-

Fig.2 Historical change in Real GDP Growth Rate and forecast

Fig.2 Historical change in Real GDP Growth Rate and forecast

Source: Cabinet “Quarterly GDP”

IMF Apr.2020 “World Economic Outlook”

Private non-residential construction investment and orders received decreased significantly

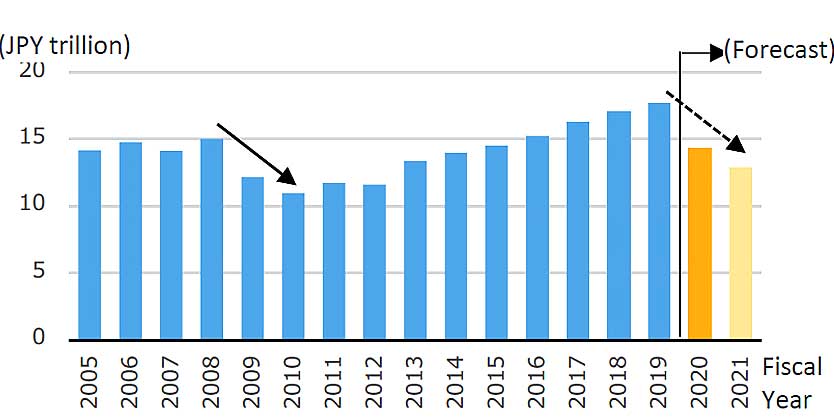

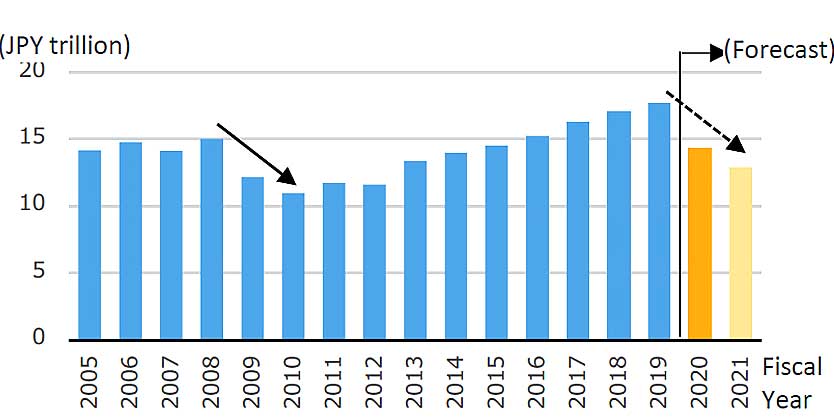

Due to the impact of the Lehman shock, private non-residential construction investment fell sharply from 15 trillion yen (FY2008) to 11 trillion yen (FY2010), down 27%. If indeed there is an impact equal to or greater than the Lehman shock, it could fall sharply from 17.7 trillion yen (FY2019) to about 13 trillion yen (FY2021) over the next two years (Figure 3). Although it is expected that government construction investment will increase in the future, it will not be able to compensate for the decrease in private demand, leading to a drastic decrease in orders received, and it is predicted that competition for orders will intensify even further.

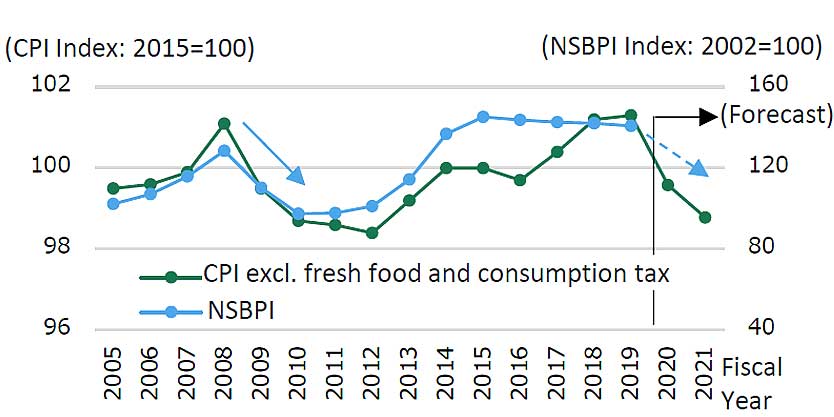

Construction prices are falling

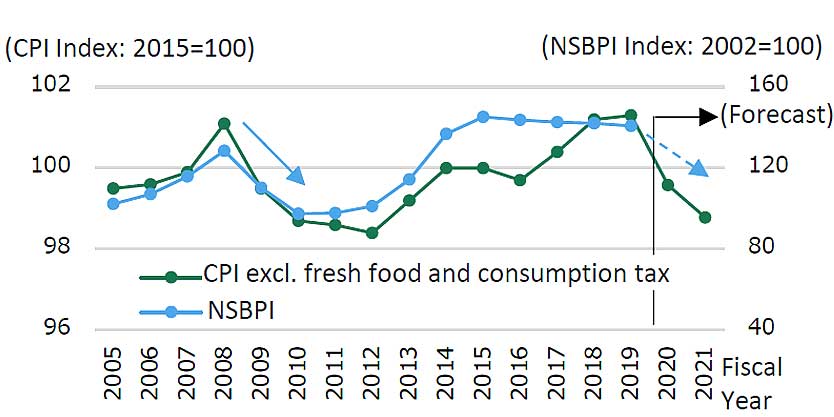

The Consumer Price Index (CPI), which has a strong correlation with construction prices, is projected to fall sharply (Japan Economic Research Center) (Figure 4). The construction industry in Japan is subject to large price fluctuations due to the formation of an oligopoly market by rank, and construction prices are projected to fall by greater than the CPI decline rate.

-

Fig.3 Historical change in Private Non-residential investment and forecast

Fig.3 Historical change in Private Non-residential investment and forecast

Source: MLIT “Construction Investment Outlook”

※2020 & 21 forecast is estimated equivalent to decrease in 2008 to 2010

-

Fig.4 Historical change in CPI and forecast

Fig.4 Historical change in CPI and forecast

Source: MIC “CPI”

JCER Report

Slow growth in orders received strengthen the downward trend of prices

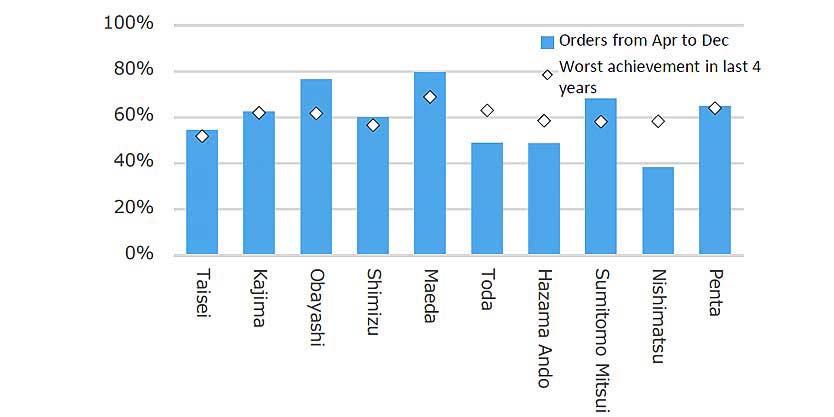

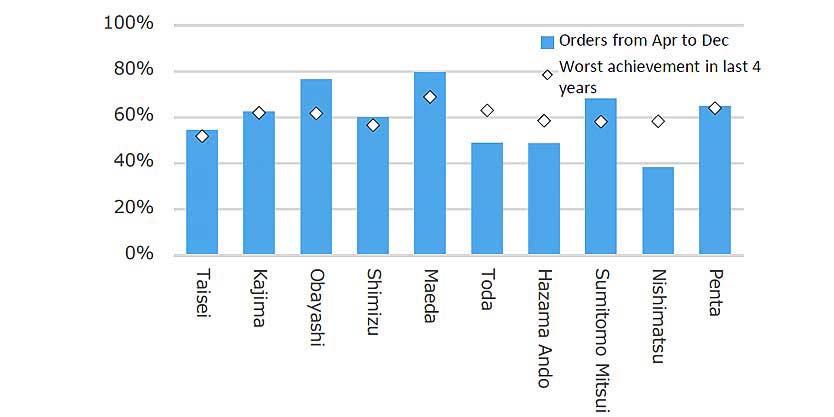

The orders received by 4 major construction companies and 6 second-tier construction companies from April to December 2019 are only 50 to 60% of the FY beginning target. Excluding Obayashi, Maeda Construction and Sumitomo Mitsui Construction, the seven companies have reached the lowest level compared to the past four years (Figure 5). In particular, Toda Construction and Ando Hazama / Nishimatsu Construction have fallen below the lowest level for the past four years. The desire of each company is extremely high, and construction prices are declining in tough competition projects.

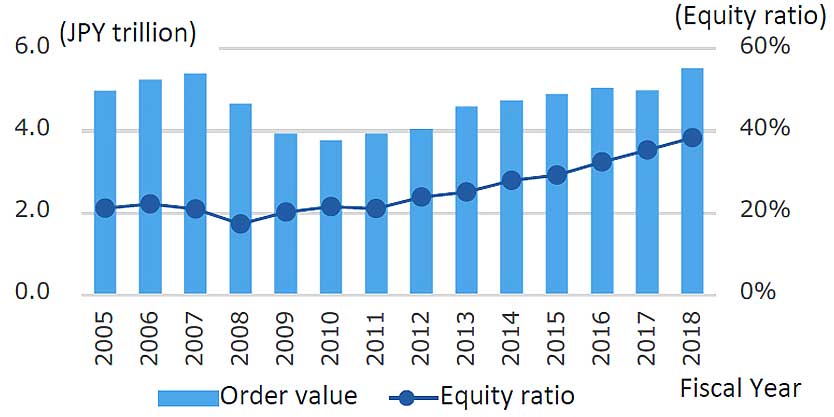

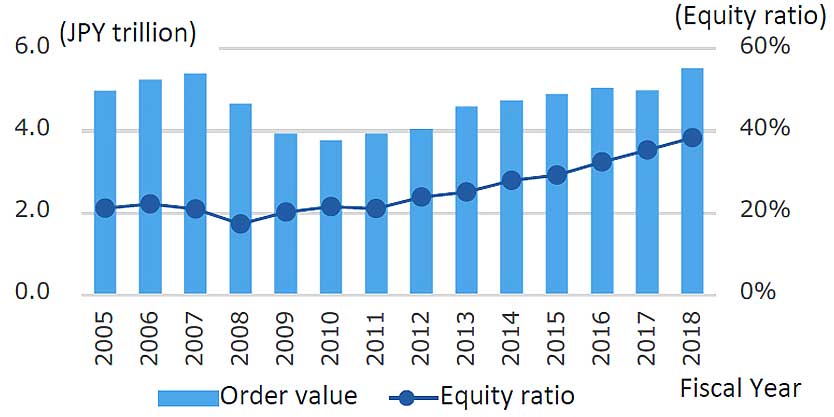

Financial status of major construction companies: Balance sheet Improvement

Due to the impact of the Lehman shock, the total construction orders of the five major construction companies fell sharply by 30% from 5.4 trillion yen (2007) to 3.8 trillion yen (2010). Since then, the Companies have made preparations for a sharp decrease in construction demand by setting the capital adequacy ratio as a priority issue, which has seen it improve significantly from 22% in FY 2006 to 38% in FY 2018 (Fig. 6)

-

Fig.5 Achievement rate of construction orders received in 3Q 2019

Fig.5 Achievement rate of construction orders received in 3Q 2019

Source: Financial Report

※Exclude Takenaka due to non-listed and Haseko

-

Fig.6 Historical change in Order Value and Equity Ratio of 5 major construction companies

Fig.6 Historical change in Order Value and Equity Ratio of 5 major construction companies

Source: RICE “Study report on Financial report of Major construction companies

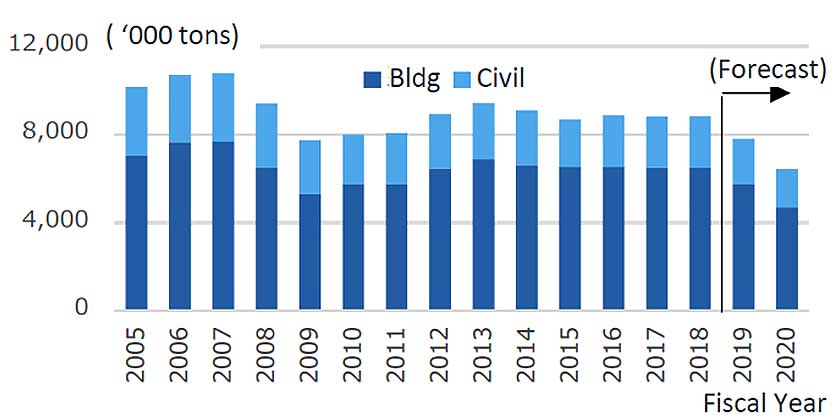

Sharp decline in domestic and overseas demand for steel products; Steel prices are declining

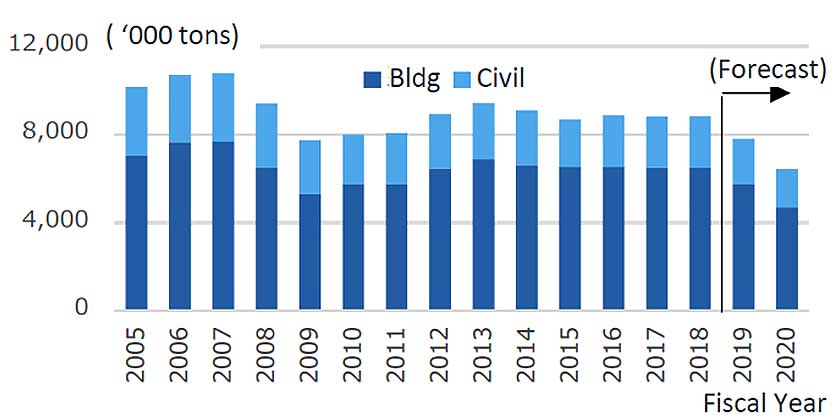

Domestic construction steel shipments have fallen sharply, and prices have continued to decrease due to inventory adjustments, pushing down the market. Furthermore, in China, the stock level of steel products at steel mills (as of the end of February 2020) has risen by 45% year-on-year to a new record high, and the inventory level is also rising. Under such circumstances, overseas steel makers such as China, Taiwan, and South Korea are trying to increase exports to Japan with the aim of reducing inventory levels, which is accelerating the decline in steel prices.

Moreover, the outlook for domestic steel demand is bleak. Demand for steel for construction in FY 2020 is expected to weaken due to the impact of COVID-19, while construction is expected to continue for urban redevelopment and civil works for reconstruction of disasters and replacement of aging social infrastructure such as those related to the national resilience policy. It is predicted that the year will be greatly interrupted (Fig. 7).

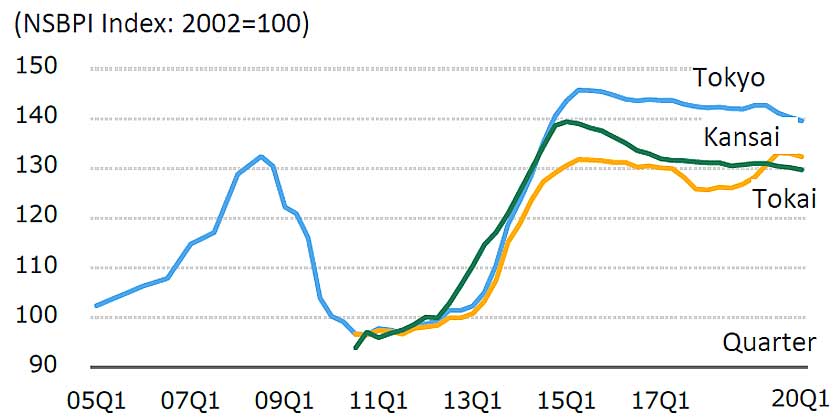

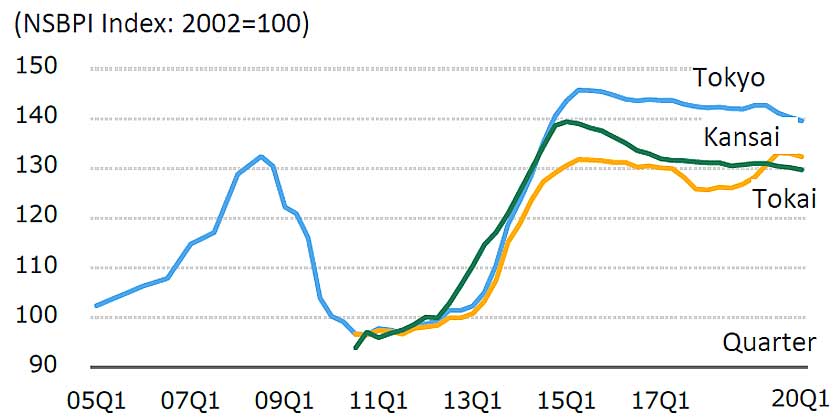

NSBPI

(Nikken Sekkei Building Price Index)

NSBPI has been on a gradual downtrend in the Tokyo, Kansai, and Tokai regions (Figure 8). The drop in the first quarter of 2020 (January-March) is due to the significant drop in building services costs such as electrical, mechanical and elevator installations.

-

Fig.7 Historical change in demand of construction steel (building and civil works) and forecast

Fig.7 Historical change in demand of construction steel (building and civil works) and forecast

Source: JISF “Domestic orders for ordinary steel for building and civil works”

※2019: Actual value for Apr to Dec. Value for Jan to Mar is from the ratio to previous year

※2020: Value is from the decreasing ration from 2018 to 2019

-

Fig.8 Historical NSBPI

Fig.8 Historical NSBPI

※Indices for Kansai and Tokai are shown after Q3 2010

Fig.1 Historical change in Business Condition Judgement

Fig.1 Historical change in Business Condition Judgement Fig.2 Historical change in Real GDP Growth Rate and forecast

Fig.2 Historical change in Real GDP Growth Rate and forecast Fig.3 Historical change in Private Non-residential investment and forecast

Fig.3 Historical change in Private Non-residential investment and forecast Fig.4 Historical change in CPI and forecast

Fig.4 Historical change in CPI and forecast Fig.5 Achievement rate of construction orders received in 3Q 2019

Fig.5 Achievement rate of construction orders received in 3Q 2019 Fig.6 Historical change in Order Value and Equity Ratio of 5 major construction companies

Fig.6 Historical change in Order Value and Equity Ratio of 5 major construction companies Fig.7 Historical change in demand of construction steel (building and civil works) and forecast

Fig.7 Historical change in demand of construction steel (building and civil works) and forecast Fig.8 Historical NSBPI

Fig.8 Historical NSBPI