Construction order environment deteriorates due to growing uncertainty

Decrease in capital investment is less than Lehman shock

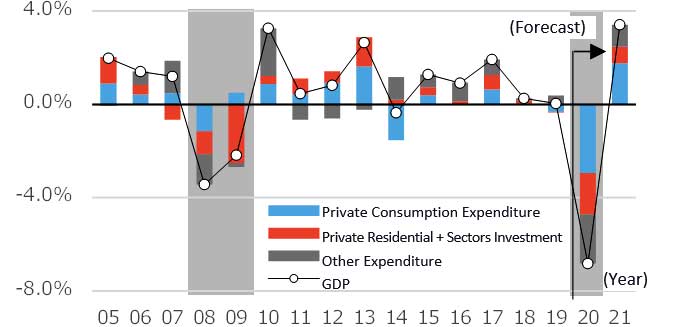

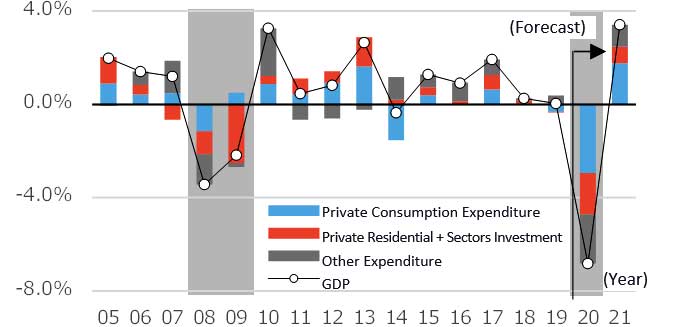

Due to the spread of COVID-19 infection, the real GDP growth rate in FY20 is predicted to be -7%, which shows the serious impact (Fig. 1). According to the detailed forecast, the negative growth factors differ between this time and the Lehman shock. In FY08/09, although it had a great impact on business entity investment activities (private residential + other sectors), the decline in final consumer expenditure was small. This time, however, the decline in final consumer expenditure is large in FY20 and the decline in private investment for housing + other sectors is smaller than in FY2009, which would suggest that final consumer expenditure impact will be severe.*

*JCER “Short Term Economic Forecast, 8 Jun. 2020”

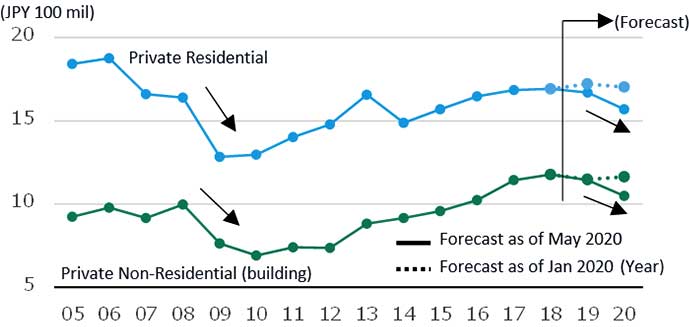

Construction investment is expected to decline;“With Corona” associated risk sees changes in construction demand

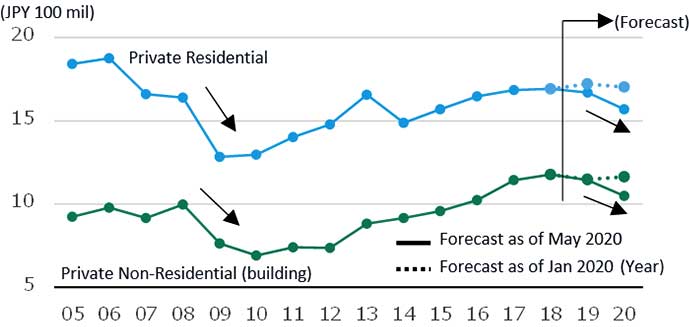

Construction investment will decrease in FY20 with reducing private investment for housing and other sectors, while it is expected to be a modest decrease compared to the Lehman shock (Fig. 2). However, there remain risks, and the construction demand for use and volume may vary significantly in line with the changes in social circumstances accompanying the “with corona” environment (changes in office work-style and lifestyles), so it is necessary to pay close attention in the future.

-

Fig.1 Historical Changes in GDP Growth Rate and Forecast

Fig.1 Historical Changes in GDP Growth Rate and Forecast

Source: Cabinet “Quarterly GDP”/JCER “Short-term Forecast”

-

Fig.2 Historical Changes in Private Residential and Non-residential Investment

Fig.2 Historical Changes in Private Residential and Non-residential Investment

Source: MLIT “Construction Investment Forecast“ / RICE “Construction Investment Forecast” (2019 and 2020)

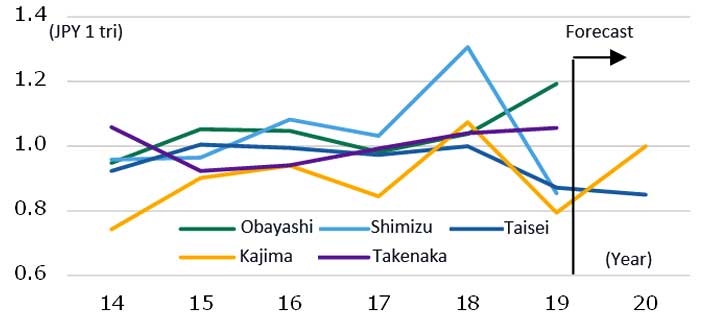

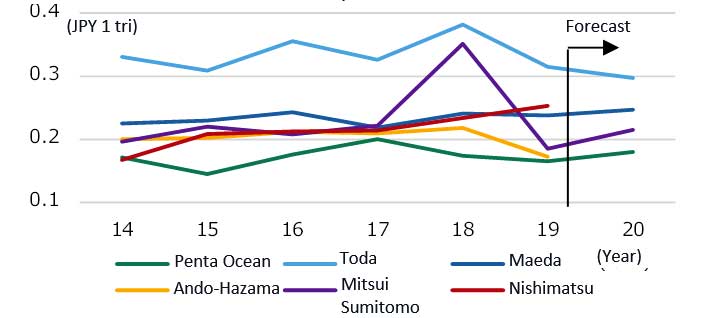

Difference in company posture is reflected in the forecast of construction orders

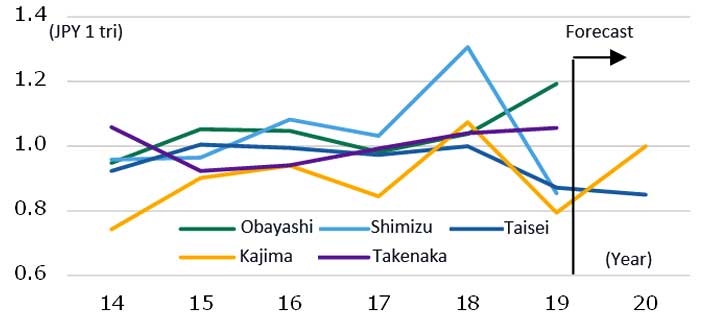

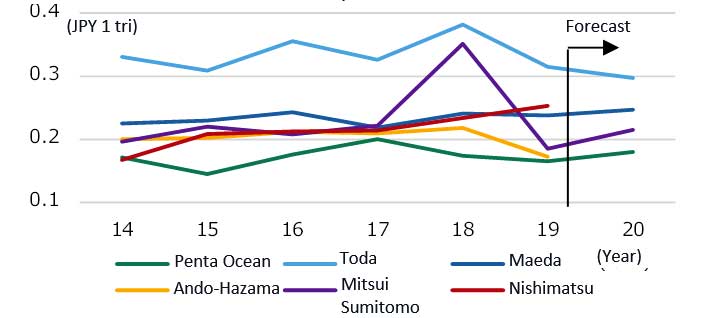

The financial results for each construction company in FY19 have been announced. Orders received by Obayashi for domestic building construction increased by 15% from the previous year, but orders to Shimizu, Taisei, and Kashima decreased by 13% to 35%, reaching the lowest level recently. In addition, there was a difference in how each company responded to the forecast for the next fiscal year. Four of the 11 companies shown in the graph have unfixed forecasts for the next fiscal year due to the effects of COVID 19. The companies that have announced their forecasts expect to increase from the previous year by securing unofficial deals, while there is a forecast that it will decrease due to investment restraint depending on different company views. Overall, there is a strong tendency to secure orders for the time being even if prices are lowered due to the deterioration in forecast of orders.

-

Fig.3 Historical Changes in Orders (domestic building) received by major construction companies

Fig.3 Historical Changes in Orders (domestic building) received by major construction companies

Source: Financial Report

※Obayashi & Shimizu unfix the forecasts of coming year

※Takenaka’s fiscal year ends December and unfixes the forecast

-

Fig.4 Historical Changes in Orders (domestic building) received by secondary major construction companies

Fig.4 Historical Changes in Orders (domestic building) received by secondary major construction companies

Source: Financial Report

※Ando-Hazama unfix the forecasts of coming year

※Nishimatsu has announced but cancelled the forecast due to Covid-19

Further decline in construction prices

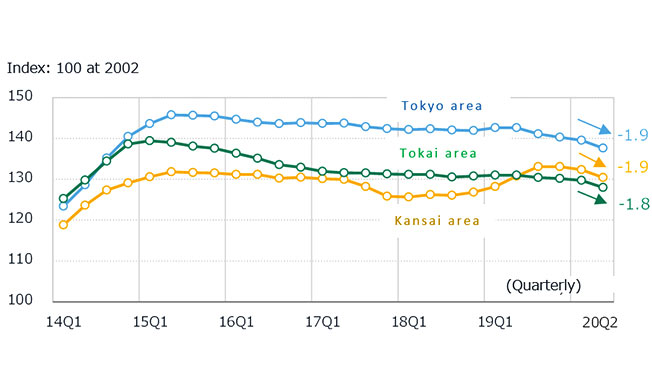

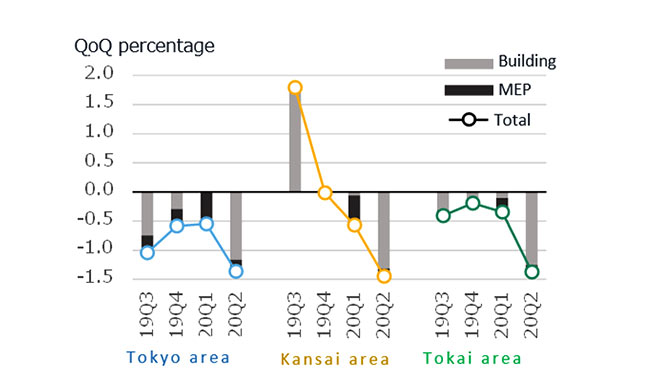

Price drop spreads for both building and services works

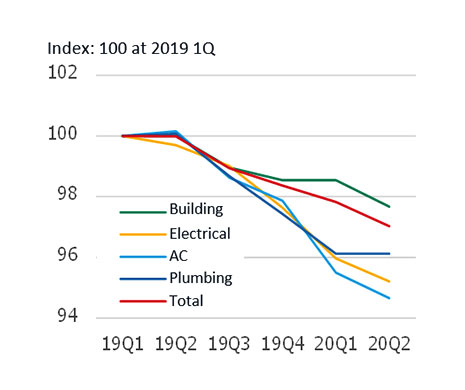

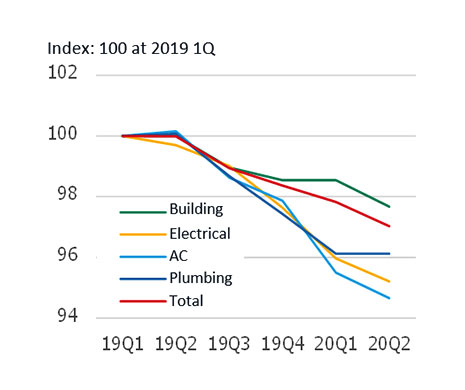

The downward trend of construction prices has been increasing since the April-June period of 2019. Looking at the changes in NSBPI by construction category (building, electricity, air conditioning, plumbing), the decline in electricity, air conditioning and plumbing is larger than that of building, which indicates the MEP price compression is ahead.

Compared to the Tokyo metropolitan area and the Tokai area, the Kansai area is behind its peak due to the expectations of the Expo and IR-related investment, but it has begun to decline since the second half of 2019. In the April-June period of 2020, the rate of decline in construction prices has accelerated more than that of MEP works.

Steel prices have been on a downward trend since mid-2019

Steel prices have fallen due to drops in scrap prices and raw material prices such as iron ore and coking coal, and a rush to sell out inventory due to sluggish steel demand such as the drastic cut in automobile production. After June 2020, domestic scrap prices have rebounded sharply in line with export prices, and iron ore and coking coal have shown slight movements, but the recovery of steel demand is still weak, so future steel prices are also expected to be weak.

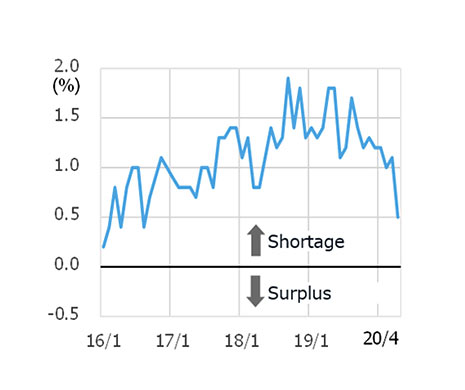

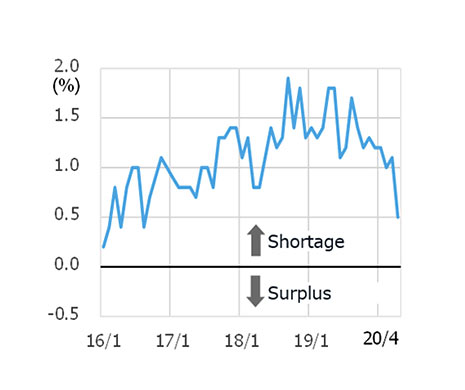

The tight labor situation is improving

Risk is in supply of foreign labor and aging workforce

The skilled labor shortage rate has been on a downward trend since the second half of 2019, and in April this year, had significantly improved by 0.6 points from the previous month. However, the risk of a shortage of labor remains high due to the difficulty of acquiring new foreign skilled workers due to the influence of the COVID 19, combined with an increase in the number of employees leaving due to reaching retirement age.

-

NSBPI: Changes in Building and Service works (Tokyo)

NSBPI: Changes in Building and Service works (Tokyo)

Source: Nikken Sekkei

-

Historical changes in Ordinary Steel Price

Historical changes in Ordinary Steel Price

Source: CRI “Construction Material Price Index”

-

Historical changes in Supply of Skilled Labors

Historical changes in Supply of Skilled Labors

Source: MLIT “Construction Labor Supply and Demand” seasonally adjusted

Fig.1 Historical Changes in GDP Growth Rate and Forecast

Fig.1 Historical Changes in GDP Growth Rate and Forecast Fig.2 Historical Changes in Private Residential and Non-residential Investment

Fig.2 Historical Changes in Private Residential and Non-residential Investment Fig.3 Historical Changes in Orders (domestic building) received by major construction companies

Fig.3 Historical Changes in Orders (domestic building) received by major construction companies Fig.4 Historical Changes in Orders (domestic building) received by secondary major construction companies

Fig.4 Historical Changes in Orders (domestic building) received by secondary major construction companies Historical NSBPI

Historical NSBPI

NSBPI increase / decrease rate and contribution of building /services

NSBPI increase / decrease rate and contribution of building /services

NSBPI: Changes in Building and Service works (Tokyo)

NSBPI: Changes in Building and Service works (Tokyo) Historical changes in Ordinary Steel Price

Historical changes in Ordinary Steel Price Historical changes in Supply of Skilled Labors

Historical changes in Supply of Skilled Labors