Construction industry outlook: Temporary recovery but shadow over future outlook

Sluggish order record increases downward pressure on construction prices

Deterioration of corporate business sentiment has stopped, but has yet to translate into recovery

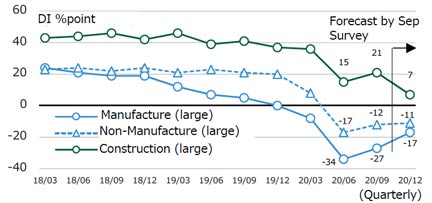

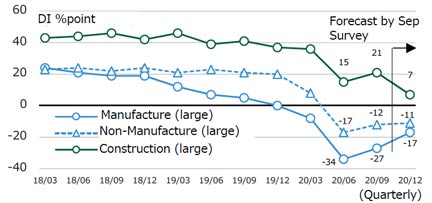

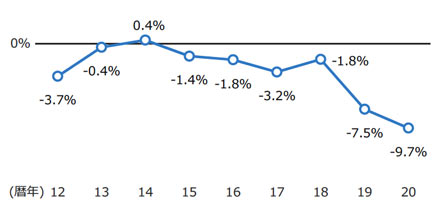

The Bank of Japan Tankan (September) business condition index improved by 7 points from the previous June survey to ▲27 for large manufacturing companies and ▲12 for large non-manufacturing industries. Although the business sentiment has recovered from the previous survey, which was affected by the Covid wreck, the DI remains in the negative range (Fig. 1). Signs of constraints on corporate capital investment are also shown due to careful consideration. In contrast, the construction industry remains in the positive range, however, the outlook has deteriorated sharply by 14 points, indicating that the outlook remains uncertain.

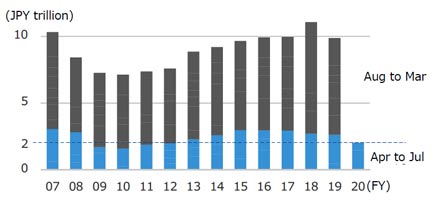

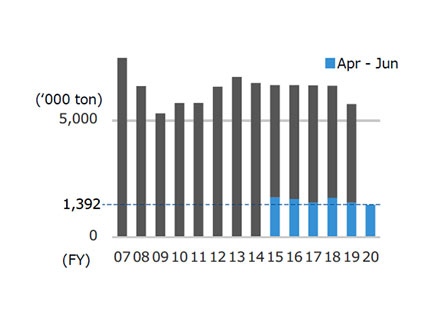

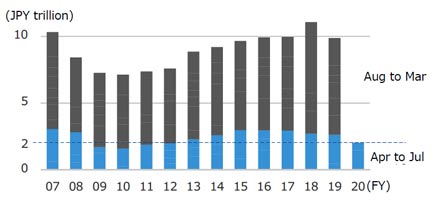

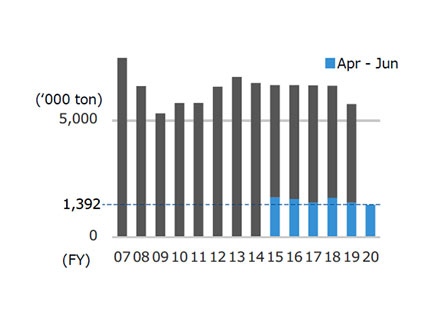

Looking at the current demand for construction, construction orders received from April to July 2020 were at a low level similar to the same period in FY2012, which was affected by the Lehman shock (Fig. 2). The total orders received by the four major construction companies* in the April-June period decreased significantly by 48% from the same period of the previous year. The reason for the decrease has been reported that the timing of orders as well as the contract is deferred to after July due to Covid-19. In case that major construction companies receive lower orders than those of last year, it will increase the possibility of hard competition among them.

*4 major construction companies excluding Takenaka Corporation who has not announced quarterly financial results.

-

Fig.1 Historical change in Business Condition Outlook DI

Fig.1 Historical change in Business Condition Outlook DI

Source: BOJ “Tankan Survey”

-

Fig.2 Historical Changes in Orders (domestic building) received by 50 construction companies

Fig.2 Historical Changes in Orders (domestic building) received by 50 construction companies

Source: MLIT “Construction Orders received by 50 companies”

Quotation price divergence widens in competition

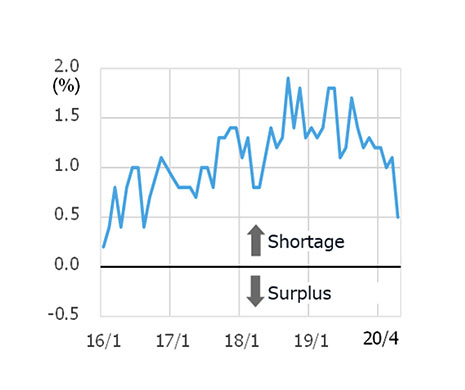

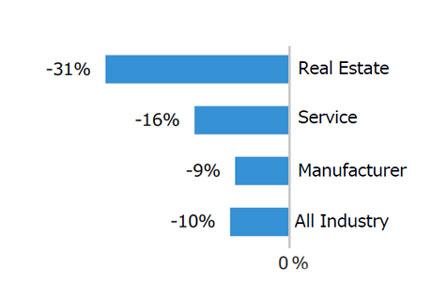

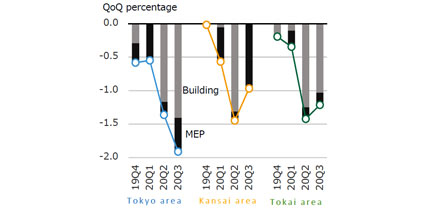

There is a growing tendency for lower quotations submitted by contractors than the estimated price. The average divergence rate* in the competition projects has increased from ▲7.5% in 2019 to its current ▲9.7% (Fig. 3). In 2019, the average divergence rate of building services works increased sharply, and this year the price decline in building works has resulted in a divergence of the same level as building services works, resulting in pushing down the whole building price.

*Average divergence rate: The average of the divergence rate between the estimated price and the quoted amount of respective project.

Slowdown in private sector capital investment

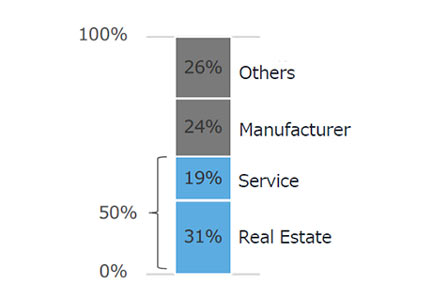

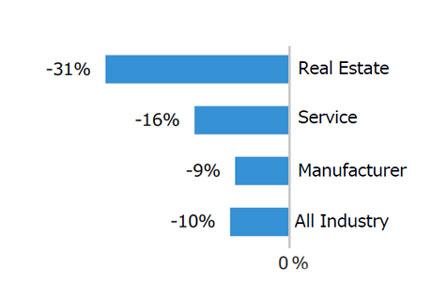

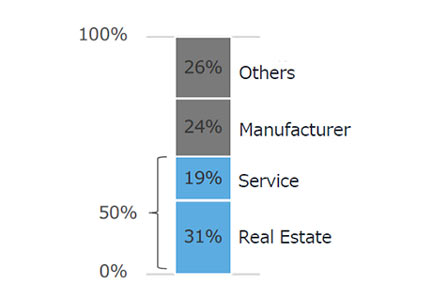

Future capital investment plans for the private sector, the real estate and service industries, which account for 50% of private construction orders and have a large impact on the construction industry, show signs of weakening investment motivation in FY2021 (Fig.4 & 5). Furthermore, unless the circumstances after Covid-19 can be illustrated, it is very likely that many capital investments will be frozen which will result in a continuing competitive environment for receiving orders and construction prices will continue to decline.

-

Fig.4 Breakdown of Client

Fig.4 Breakdown of Client

Source: MLIT “Construction Orders received by 50 companies”

※Breakdown of 2019 Private sector

-

Fig.5 Capital investment plan by industry

Fig.5 Capital investment plan by industry

The rate of increase / decrease in the FY21 plan with respect to the FY19 results

Source: DBJ “Survey on Planned Capital Spending”

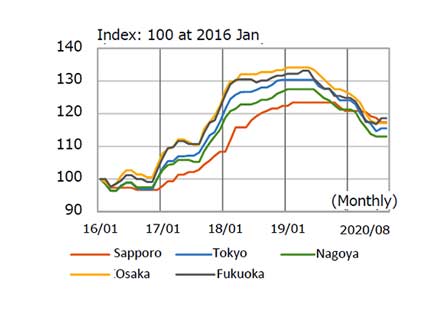

Further decline in construction prices

With the exception of structural work and temporary works, prices of building works are falling. Of building services works, some parts of equipment costs and labor costs continue to decline from the previous fiscal year. The rate of decline is increased due to a decrease in demand.

Significant decline in electrical works and elevator/escalator installation.

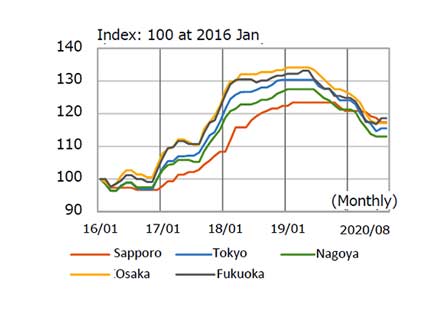

Due to sluggish construction market conditions including restraint of capital investment by manufacturers and rising vacancy rates of rental offices, construction prices have fallen in structure, finishing and mechanical works.

Drop in Steel prices stops

The prices of iron ore and steel scrap, which are the raw materials for steel, are rising. The main factors are the increase in crude steel production in China and the unstable iron ore production in Brazil, one of the major production countries. The demand for steel scrap is recovering overseas and the market price is rising. In contrast, due to the decrease in demand for steel products worldwide, those cost increases have not been transferred to the market price and the steel product price has been flat since last July.

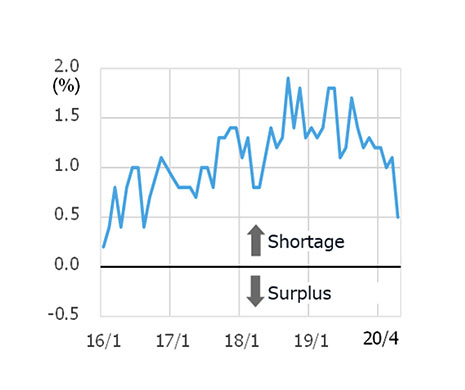

Labor supply and demand is flat

The gap between labor supply and demand has narrowed and flattened out from April 2020. The outlook for labor supply in the next few months will not change significantly, and the current situation is expected to continue. The number of construction skilled workers is sufficient and may be excessive depending on the future construction demand.

-

Historical changes in Demand of Ordinary Steel

Historical changes in Demand of Ordinary Steel

Source: JISF “Domestic Order for Ordinary Steel

-

Historical changes in Ordinary Steel Price

Historical changes in Ordinary Steel Price

Source: CRI “Construction Material Price Index”

-

Historical changes in Supply of Skilled Labors

Historical changes in Supply of Skilled Labors

Source: MLTI “Construction Labor Supply and Demand” seasonally adjusted

Fig.1 Historical change in Business Condition Outlook DI

Fig.1 Historical change in Business Condition Outlook DI Fig.2 Historical Changes in Orders (domestic building) received by 50 construction companies

Fig.2 Historical Changes in Orders (domestic building) received by 50 construction companies Fig.3 Average divergence rate of price competition

Fig.3 Average divergence rate of price competition Fig.4 Breakdown of Client

Fig.4 Breakdown of Client Fig.5 Capital investment plan by industry

Fig.5 Capital investment plan by industry Historical NSBPI

Historical NSBPI

NSBPI increase / decrease rate and contribution of building /services

NSBPI increase / decrease rate and contribution of building /services

Historical changes in Demand of Ordinary Steel

Historical changes in Demand of Ordinary Steel Historical changes in Ordinary Steel Price

Historical changes in Ordinary Steel Price Historical changes in Supply of Skilled Labors

Historical changes in Supply of Skilled Labors