Cost Management Report

January-March 2025 issue.

「Construction Cost Trends Show Signs of Change; Weakness in Surge Centers on Building Construction」

Scroll Down

This report has been prepared by the Cost Management Group of Design & Technical Dept. of Nikken Sekkei Ltd for information purposes. While the information in this report is current as of the date of publication, its completeness is not guaranteed. The contents are subject to change without notice. Unauthorized reproduction of this report is prohibited.

Construction Cost Trends Show Signs of Change; Weakness in Surge Centers on Building Construction

Current momentum of construction price hikes weakens

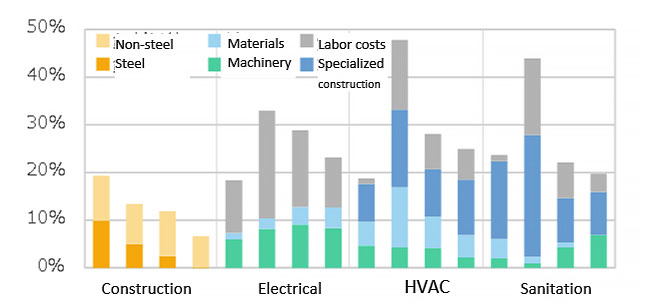

Labor costs and specialized construction work spur rise in MEP work

-

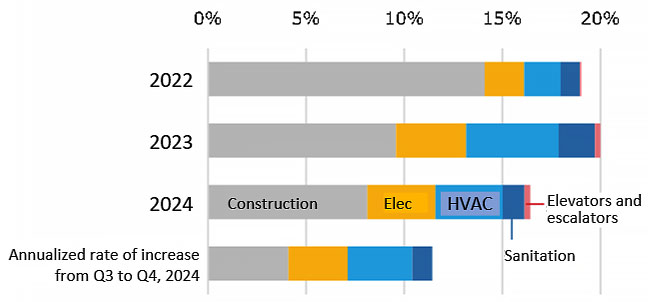

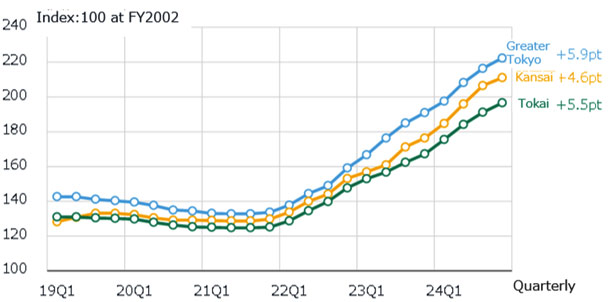

Fig. 1: Annual increase in NSBPI*1

Fig. 1: Annual increase in NSBPI*1

Compiled from Nikken Sekkei data.

-

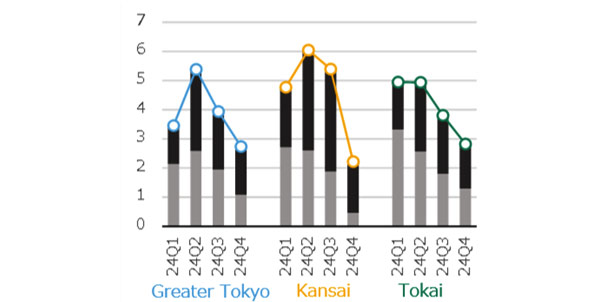

Fig. 2: Trends in annual rates of increase and contribution to NSBPI by construction work type

Fig. 2: Trends in annual rates of increase and contribution to NSBPI by construction work type

For each construction type, from left to right: (1)annual rate of increase in 2022, (2) annual rate of increase in 2023, (3) annual rate of increase in 2024, (4) annual rate of increase in 2024 for Q3-Q4. Prepared by Nikken Sekkei. Air conditioning materials include duct work costs.

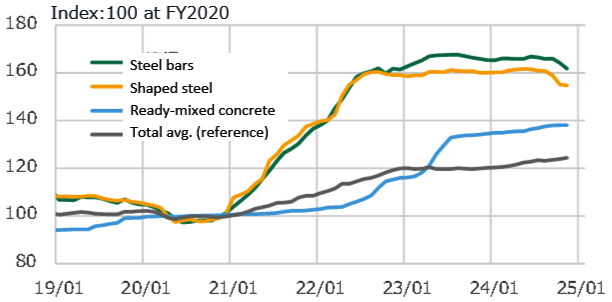

Steel prices fall but ready-mixed concrete prices rise

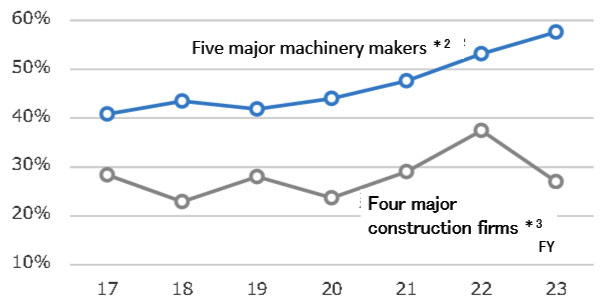

Machinery subcontractors are becoming more selective in their orders for industrial MEP

-

Fig. 3: Steel and ready-mixed concrete prices

Fig. 3: Steel and ready-mixed concrete prices

Compiled from the Bank of Japan's Corporate Goods Price Index. -

Fig. 4: Ratio of industrial facilities construction-to-orders received

Fig. 4: Ratio of industrial facilities construction-to-orders received

Prepared from each company's financial data.

Momentum Weakens, but Continues to Rise

Nikken Sekkei Standard Building Price Index NSBPI *1

For MEP work, labor, specialized construction costs, as well as cost-to-income ratios rose, albeit at smaller rates than in the past. In the Kansai region in particular, there were efforts to reduce prices at some projects, depending on the application and project size. On the other hand, on some types of construction projects, upward pressure on materials prices such as concrete, along with labor costs, is increasing, necessitating close monitoring.

-

Fig. 5: Changes in NSBPI

Fig. 5: Changes in NSBPI

※The display period has been changed from this issue. -

Fig. 6: % Change in NSBPI, Construction Work vs. MEP Work Contribution

Fig. 6: % Change in NSBPI, Construction Work vs. MEP Work Contribution

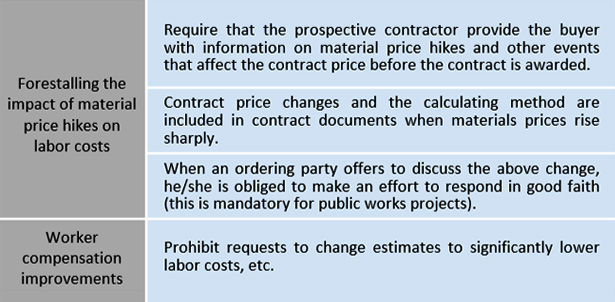

Revisions to the Construction Industry Law and other laws have changed contracting rules

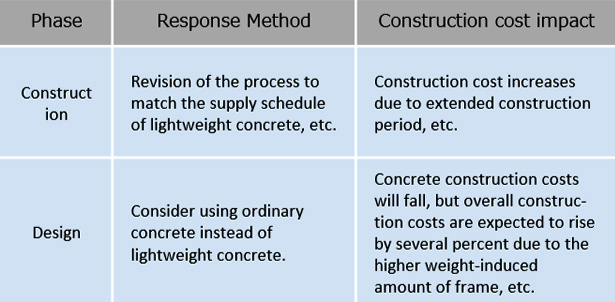

The risk of increased construction costs due to lightweight concrete shipment restrictions persists

-

Fig. 7: Major impacts of revisions to the Construction Industry Act and other laws on private sector clients

Fig. 7: Major impacts of revisions to the Construction Industry Act and other laws on private sector clients

Prepared by Ministry of Land, Infrastructure, Transport and Tourism (MLIT)’s “Third Generation Three Bearer Laws” (Construction Industry Act, Public Works Procurement and Contracts Act, and Public Works Quality Assurance Promotion Act).

-

Fig. 8: Impact of restrictions on shipments of lightweight concrete

Fig. 8: Impact of restrictions on shipments of lightweight concrete

Prepared by Nikken Sekkei.

*1: The Nikken Sekkei Standard Building Price Index (NSBPI) shows movements in construction prices, calculated independently by Nikken Sekkei Ltd. Using standard rental office space as a quantitative model, the index is calculated and converted into an index of construction prices that reflect prevailing prices, as identified through independent surveys from time to time. The first quarter (Q1) is from January to March, Q2 is April - June, Q3 is July - September, and Q4 is October - December.

*2: Four companies: Asahi Kogyosh Co., Ltd. Taikisha Ltd. DAI-DAN Co., Ltd. and Takasago Thermal Engineering Co., Ltd.

*3: Five companies: Obayashi Corporation, Kajima Corporation, Shimizu Corporation, Taisei Corporation.